- ApeCraft

- Posts

- The Retailer That Keeps Giving

The Retailer That Keeps Giving

(While the Rest Barely Survive)

It’s a few of us now. And we’ve been busy: making money. Some tickers we’ve made money on recently: $BYON ( ▲ 6.01% ) $UBER ( ▼ 0.59% ) $XYZ ( ▲ 4.85% ) $DIS ( ▲ 3.55% ) $CROX ( ▲ 1.56% ) $DOCS ( ▼ 16.78% ) $NKE ( ▲ 1.95% ) $RDDT ( ▼ 7.43% ) $BBAI ( ▲ 15.69% ). We did share about it but well, we don’t blame you for not trusting random Apes in cyberspace!

This is a Guest Post from Ape Demon. He is one of us at ApeCraft. His conviction. His money. His words. I have nothing to add, except congratulating him to have finally gotten it out of his system and sharing for the benefit of those who’d read it and may end up losing money.

— Apetimus Prime

Grocery retailers are a snoozefest. Seriously. Every quarter, they throw confetti if they hit a 5% net operating margin—as if that’s something to brag about in 2025. Meanwhile, tech bros are raking in 20%+ margins like it’s a side hustle. But amid this penny-pinching retail landscape, there’s one rebel who said, “Nah, I’m not playing your broke game.” That’s Dollarama ($DOL.TO).

How Discounters (Without the Lettuce) Won

At first glance, non-food discount retail feels weird—almost incomplete. Like dating without the relationship drama. But zoom out, and you realize: it’s genius.

Groceries are the ball and chain of retail. Supermarkets sell eggs and milk at razor-thin margins just to get people in the door. Sam Walton practically built a dynasty on this trick. Great for footfall. Terrible for profits. And yet, every supermarket still plays this ancient game.

Not Dollarama.

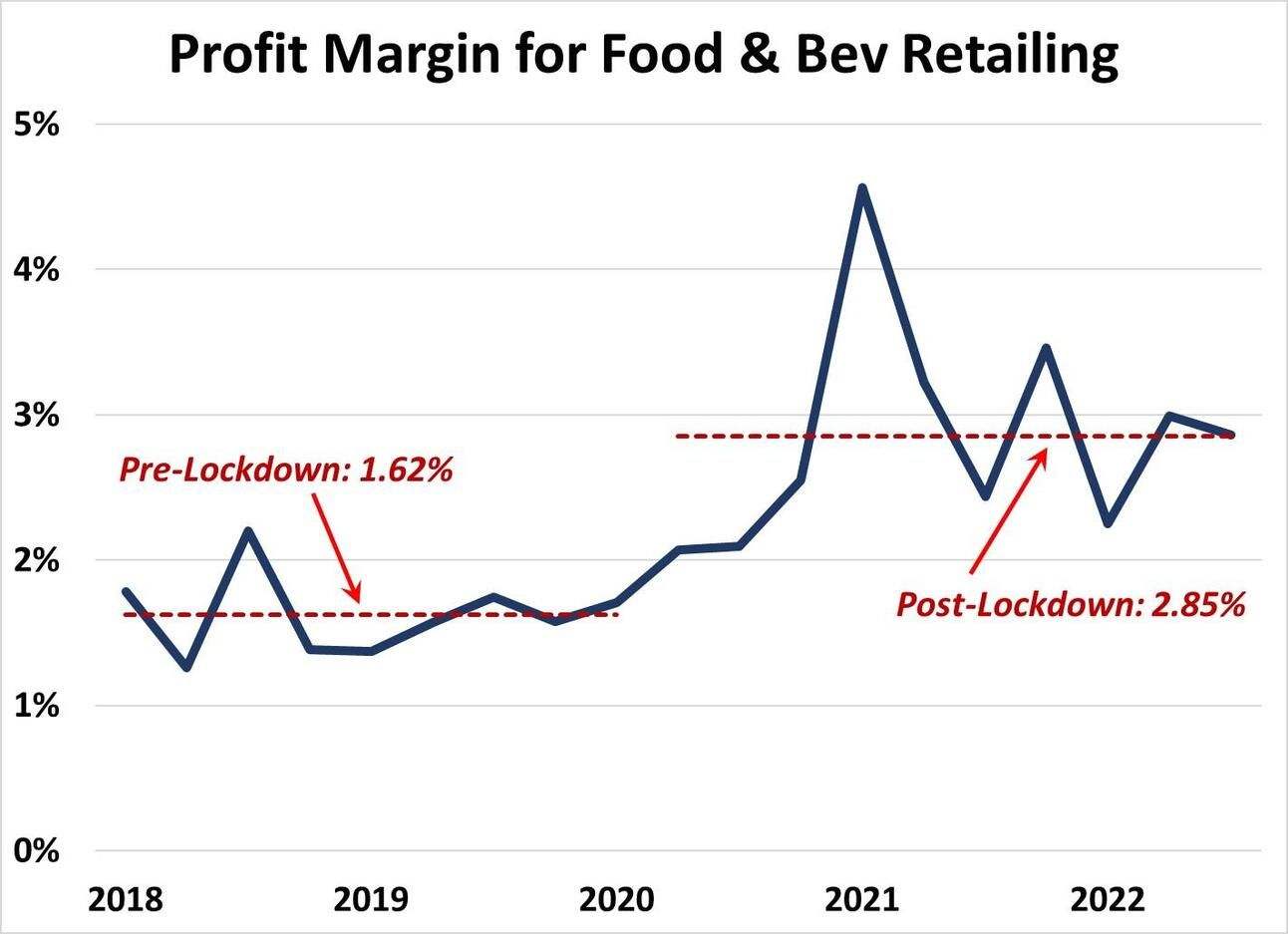

My way of making this post look serious. You may not take it seriously without a chart!

The Breakup With Boring Retail

Look, I’ve played the traditional game. Walmart. Target. Costco. I’ve been there. Made a few bucks post-COVID. But that was then. This is now. Shareholders want the bottom line to actually look like a line—and not a pothole.

Costco? Publicly admits their net operating margin is around 3%. And with the Orange Man’s tariff tantrums, private label brands at these stores are about to get smacked hard. Think higher input costs, squeezed margins, and the inevitable price hikes.

Cue the consumer pullback. Spending slows. Revenues stall. The music stops.

But you, my dear reader, aren’t here for mainstream wisdom. You’re here because you like to dig deeper and think sharper. I respect that. So let’s unpack why Dollarama is that rare beast in retail that actually makes money.

Year | Stores | SSS Growth | Revenue | Gross Margin | NOPM | EPS | FCF | New Markets |

|---|---|---|---|---|---|---|---|---|

2021 | 1400 | +3.2% | $4.03B | 43% | 25.06% | $1.81 | ~$0.9B | Canada |

2022 | 1486 | +12% | $4.33B | 44% | 26.10% | $2.18 | ~$1.1B | Canada |

2023 | 1551 | +12.8% | $5.05B | 44.6% | 23.56% | $2.76 | ~$1.2B | Colombia |

2024 | 1640 | +12.8% | $5.87B | 46.3% | 25.55% | $3.56 | ~$1.3B | Guatemala, El Salvador |

2025 | 1700 | +4.5% (est) | >$6.0B | 45.4% (est) | 18.84% | TBC | $1.45B | Australia |

Let me say it loud for the retail analysts in the back: NOPM above 20% in the discount segment is not normal. It's borderline illegal (not really, but you get the point).

Why Dollarama Leaves Everyone in the Dust

Most discounters struggle to hit mid-single-digit margins. Dollar Tree dreams of 8%. Dollar General manages 3% on a good day. Costco’s out here scraping 3% and still somehow gets applause.

But Dollarama? Sitting pretty at 20–26%. That’s Tapestry and Williams-Sonoma-level margins, and those folks sell overpriced throw pillows and silk robes.

So What’s the Secret Sauce?

Direct Factory Sourcing – Not just private label. Dollarama negotiates directly with brand factories overseas and bypasses layers of middlemen. That’s money in the bank.

Treasure Hunt Store Format – Shoppers don’t know what they’ll find. Neither do store managers. That’s intentional. It creates FOMO on shelves—and drives repeat visits.

Centralized, Data-Obsessed Planning – Behind the chaos is ruthless planning. SKUs are rotated constantly based on what’s actually selling. The planogram isn't static. It evolves.

Flat Price Point, Big Margins – Everything under $5 CAD. And yet, 45% gross margins and 20%+ operating margins. That’s what happens when you don’t try to sell everything—but focus on what moves.

Smart Market Expansion – Now that the Canada model is ironclad, they’re buying weak players in second-tier global markets: Colombia, El Salvador, Peru, Guatemala, Australia. (Mexico’s next… shh.)

So… Buy Now or Cry Later?

I bought in at $95. It’s at $195 today. I’m not here to tell you what to do with your life, but I am telling you I see this going to $300 by end of next year.

If you're still waiting for confirmation, call me when it hits $250. I know a few Apes (even Apetimus Prime himself?) who passed at $95 is kicking himself.

Go visit one of their stores this weekend. Watch the checkout line. Ask yourself: “Why am I not invested in this?”

But well, why would you listen to this random Ape?! Choice is yours, friend. Choice is always yours.

Sincerely ;)

Ape Demon

Reply